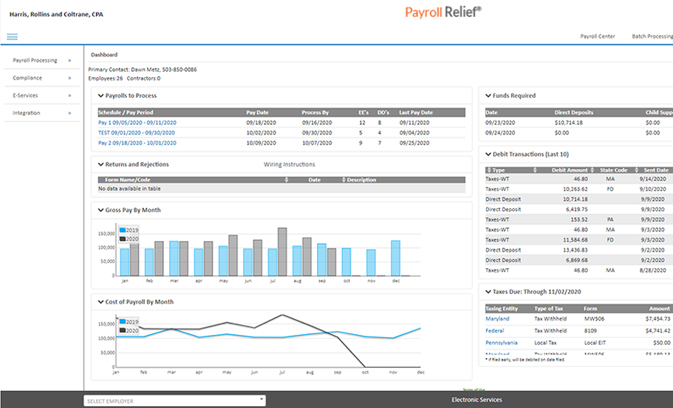

Our top-notch payroll software for accountants includes everything you need for a high-performance payroll practice

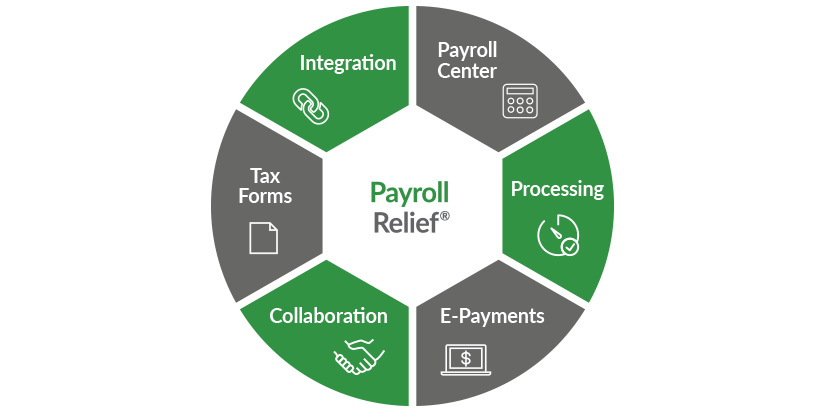

Payroll Relief pays great attention to the major areas that determine the performance of a payroll system – streamlined workflow, comprehensiveness, automation, customization, integration, and management tools.

Get started   Download brochure

“Payroll Relief is the most accountant-friendly and reasonably-priced payroll system in the U.S. market.”

– CPA Practice Advisor, October 2021